The cfd trading offers immense opportunities for traders to potentially capitalize on price movements without owning the underlying assets. However, trading CFDs successfully demands a strategic approach tailored to navigating market volatility. Effective market analysis is at the core of becoming a smart trader. Here’s a concise but comprehensive guide to analyze the CFD market effectively.

Understand Price Trends and Patterns

The first step in analyzing the CFD market is identifying price trends. Look for upward (bullish), downward (bearish), or sideways (neutral) trends over a specified timeframe. Use price charts and historical data to spot recurring patterns such as head-and-shoulders, triangles, or flags. These patterns often provide clues about future market movements, helping traders make informed decisions.

For instance, a breakout from a triangle pattern could signal the next significant price move. Ensure you consider both short-term trends (for quick trades) and long-term trends (for broader strategy planning).

Examine Fundamental Market Drivers

Fundamental analysis is essential when trading CFDs, especially if you’re focusing on assets like stocks, forex, or commodities. For stock CFDs, monitor corporate earnings reports, industry news, and macroeconomic factors like GDP growth and interest rate changes. For forex CFDs, keep an eye on geopolitical events, central bank policies, and economic data like inflation rates.

Fundamental factors influence the supply and demand dynamics, creating market volatility. This volatility provides trading opportunities but requires traders to stay updated on market-moving news.

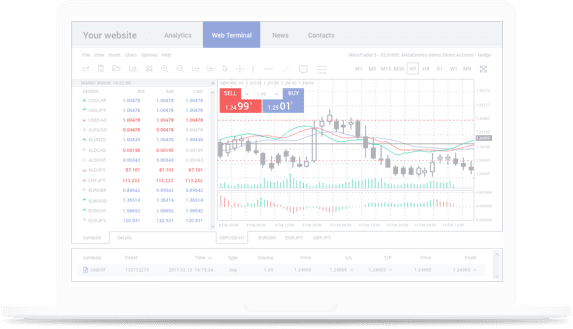

Leverage Technical Indicators

Technical indicators are powerful tools for analyzing CFD markets. Use indicators such as Moving Averages (MAs), Relative Strength Index (RSI), and Bollinger Bands to identify potential entry and exit points. For example:

• A crossover of short-term and long-term moving averages may signal a change in trend direction.

• RSI values above 70 or below 30 indicate overbought or oversold conditions, pointing to potential price reversals.

Combining indicators enables you to cross-verify signals for higher accuracy.

Monitor Sentiment and External Factors

Market sentiment plays a significant role in CFD price movements. Analyzing public sentiment through market sentiment indicators or reading headlines can help traders anticipate shifts in price momentum. Additionally, remain attentive to external influences like global economic stability, natural disasters, or political unrest, as these can cause sudden movements in the CFDs you trade.

Make Data-Driven Decisions

Successful CFD trading is built on disciplined, data-driven decisions. Avoid emotional trading by maintaining a comprehensive trading journal to track your decisions and outcomes. Analyzing past trades provides valuable insights into refining your trade strategies and enhancing future performance.

0